Flood Zone AE

What is Flood Zone AE?

Get Insured in Flood Zone AE

Flooding is the country's most common weather-related disaster, costing home and business owners billions annually. According to FEMA, it takes just one inch of water to cause $25,000 in damages This means your home and business could be at risk without flood insurance coverage.

Millions of people are currently unprotected, relying on homeowners' insurance to cover them should the worst happen. At Rocket Flood, we believe responsible home and business owners should always carry flood insurance, even if coverage isn't mandated in your state.

If you live in an AE flood zone, you reside in the highest flood-risk zone. Defend your property from the worst-case scenario with a Rocket Flood insurance policy today.

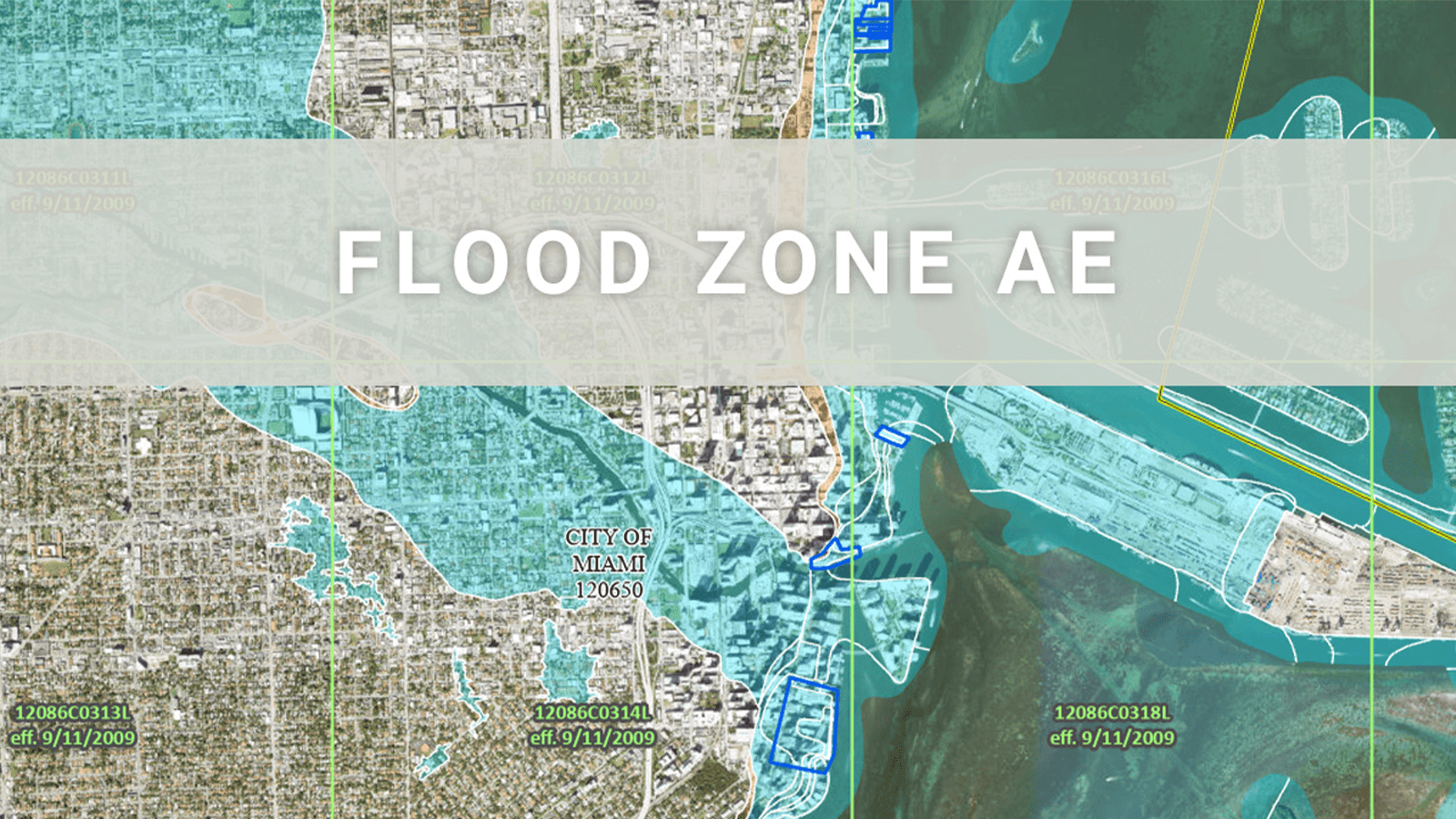

What is Flood Zone AE?

FEMA divides every corner of the country into different flood classifications. At Rocket Flood, we strongly recommend that everyone holds flood insurance, but your risk is greater if you reside within floodzone AE.

What does flood zone AE mean?

The official flood zone AE meaning is an area with a 1% chance of annual flooding and a 26% chance of flooding over the next 30 years. Flood insurance zoning maps are essential for determining how much you pay for coverage.

We understand the complexities of getting the best rates on your flood insurance, which is why we go the extra mile to source the most affordable rates from more than 20 A-rated flood insurers.

How to Buy Flood Insurance in Zone AE

Ensuring you get the best deal on flood zone AE insurance could save you hundreds of dollars annually. Our clients can save up to 40% on their monthly insurance premiums by getting their quote through Rocket Flood.

As someone in a high-risk flood area, shopping around is even more critical to lowering your flood insurance costs. Our platform makes it quick and easy to browse the insurance market in real time.

Our mission is to make insurance simple for our clients. With our industry-leading 1-2-3 application process, ensuring your home and business are fully protected has never been simpler.

Follow our three easy steps to ensure you are covered against flooding in your area:

The Rocket Flood customer support team is always available to answer any questions you have about your coverage.

Enjoy the peace of mind that comes with being fully covered against severe flooding within high-risk AE zones across the country.

As a nationwide insurance platform, we are the industry's leading agency in connecting clients with top-tier protection against flooding wherever they live.

Rocket Flood supports you in sourcing the best insurance plans for residential and commercial properties. Whether you want to protect your lakeside home or open a business in a flood-prone town, we have the policies for you.

Get your Rocket Flood insurance quote for home and business owners in flood zone AE today.

Flood Zone AE FAQs

It can be challenging to understand the true AE flood zone meaning. It can also be difficult to determine how it impacts your flood insurance rates. Here are answers to some of Rocket Flood clients' most common questions.

Don't see your question below? Check out our FAQs page .

{{ faq.q }}

{{ faq.q }}

What is the best flood zone rating?

Typically, the safest flood zone rating is X. These flood zones are also known as X500 zones, meaning they are located outside the 500-year floodplain. Moreover, they are typically protected by flood protection mechanisms within the 100-year floodplain, such as levees or dams.

However, it's essential to recognize that you are never 100% protected from floods, even within the safest flood zones. In reality, 99% of counties within the U.S. have experienced at least one flooding event within the last 50 years.

For this reason, we strongly recommend taking out flood insurance. Expect to pay far lower premiums if your home or business is located within an X-rated flood zone.

Is an AE flood zone bad?

The worst flood zone classification in America is zone V. A V-rated flood zone includes beachfront properties or real estate on the edges of rivers or lakes with low elevation. Coastal properties at or below sea level may also be classified as a V-shaded flood zone.

Premiums on V-rated flood zones can cost thousands of dollars annually due to the inherent risk of owning a home or business within these zones.

How much is flood insurance in zone AE?

Like all forms of insurance, your premiums depend on various factors, such as the value of your property, its contents, and how many policy enhancements you wish to include as part of your package.

Do private flood insurance companies offer elevation discounts in zone AE?

However, many Americans are unaware that most private insurers have special elevation discounts. Homes and businesses at higher elevations can qualify for lower premiums if they can prove their elevation.

Rocket Flood uses state-of-the-art LiDAR technology to measure the precise elevation of your home or business. This enables us to win discounts of up to 40% on premiums for our clients.

Can I get private flood insurance in a high-risk flood zone?

However, private flood insurers will still provide insurance to homes and businesses in these areas. It is always worth shopping around to ensure you get the best insurance policy deal.

Will homeowners' insurance cover flood damage in zone AE?

For example, if a tree falls through your roof, you could claim for the damage caused by the subsequent flooding.

The only way to ensure total protection in every circumstance is to get flood insurance coverage.