Flood Insurance Cost

How Much Flood Insurance Costs?

Flooding costs the nation billions annually as the most common form of natural disaster. High flood insurance costs are why many Americans don,t protect their homes and businesses or discontinue flood coverage.

Flood insurance does not have to be as expensive as you think. According to the National Flood Insurance Program (NFIP), the average premium for public flood insurance is just $995 per year.

But counties have massive variations. For example, private insurance within Texas's “B” flood zone costs just $427 annually, whereas it can cost $13,000 if you reside in the “V” zone (the highest-risk flooding zone).

Remember that NFIP policies may be cheaper, but you must purchase and pay for two separate policies to cover a building and its contents. The cost of flood insurance from the private sector covers both in one simple policy.

States also differ in their insurance pricing. For example, Idaho's average flood insurance cost is $820, whereas Iowa's is $1,207.

So many factors go into determining the average cost of flood insurance in your area. At Rocket Flood, we believe in transparency, so we have broken down the primary factors influencing how much you pay for your flood insurance.

Risk Rating 2.0

FEMA is changing the way flood risk is calculated. Instead of relying on basic measurements, Risk Rating 2.0 is the system that incorporates a more advanced methodology to deliver fairer prices.

Risk Rating 2.0 has turned the industry on its head, with radical changes in premiums expected as insurers adjust their premiums to reflect actual risk.

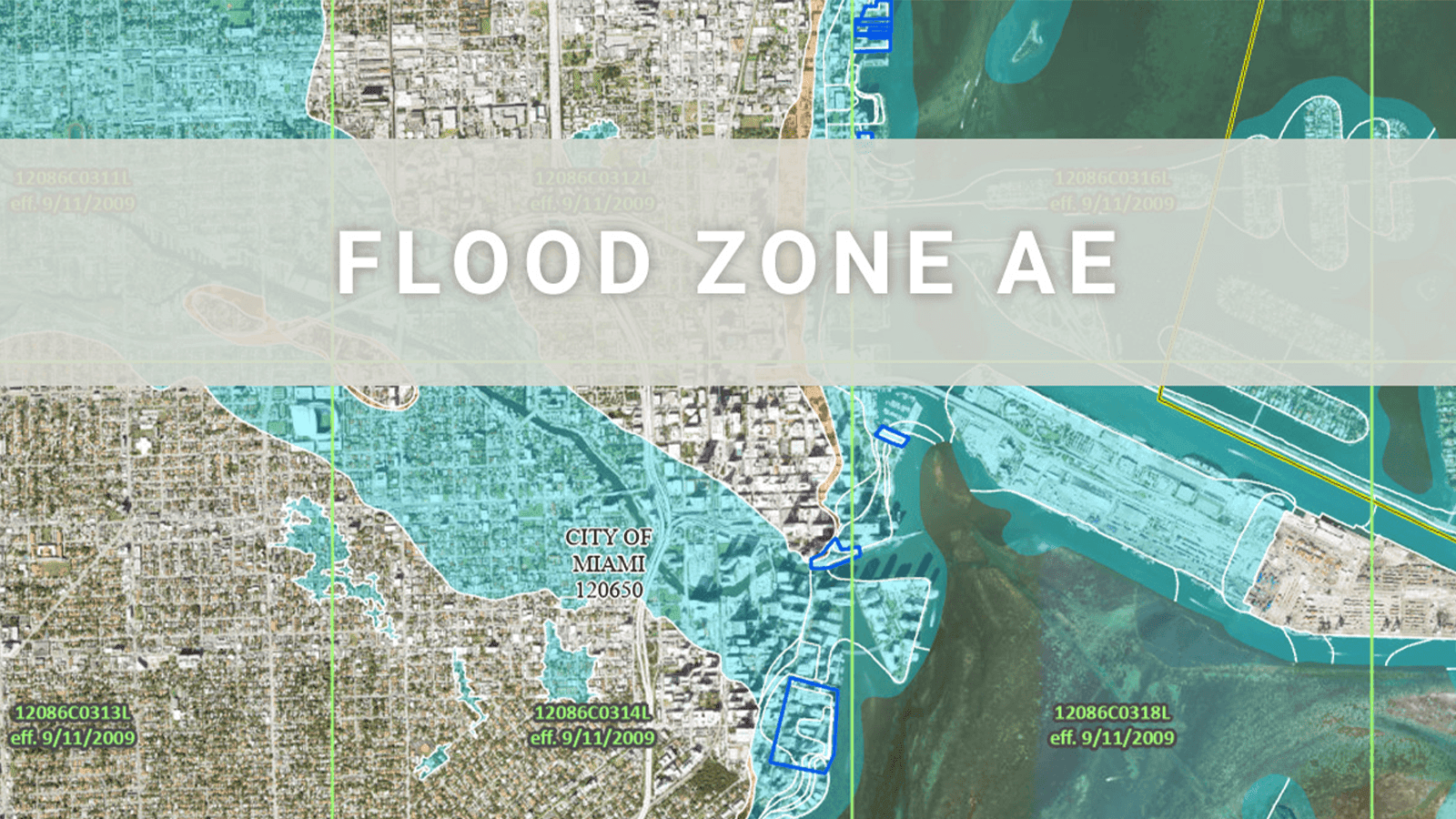

Flood Zone

Your flood zone, as designated by FEMA, indicates the chances of you experiencing a flood that could damage your home or business.

FEMA has categorized every area of the country according to its lettered grading system. If you live in an “A” or “V” zone, you are in the highest flood risk zone, so your premiums will be higher.

Work with Rocket Flood to find the best rates on your insurance premiums using our flood insurance calculator.

Type of Coverage

Like all forms of insurance, the more coverage you choose, the more your policy will cost. We believe that you should only pay for the coverage you actually require.

Contact the team at Rocket Flood to learn more about your coverage needs. We can make tailored recommendations for any necessary policy enhancements.

Enhancements are the added extras not contained within ordinary flood insurance policies. Most home and business owners will not require these, but they are always there with Rocket Flood if they do.

Our policy terms and conditions are always transparent, enabling you to see what is and isn't included in your policy.

Coverage Limit and Deductible

Higher coverage limits mean your insurer is on the hook for more money if the worst should happen. Private insurance policies offer far higher coverage limits, with our policies providing up to $5,000,000 for personal and $20,000,000 for building contents.

These maximum limits far exceed those provided under NFIP policies, which rarely cover the total cost of the damages incurred during a major flooding event.

Your deductible also influences your flood insurance cost. Deductibles are the amount that must be covered by you, the policyholder, before your insurer will step in to cover the remainder of the cost. Opt for a higher deductible to reduce your premiums.

Property Elevation

Property elevation is the most crucial factor in determining your flood insurance estimate. Properties with a higher elevation are naturally less susceptible to flooding than properties within low-lying coastal areas.

You can certify your property's elevation by obtaining an elevation certificate. A professional surveyor determines these numbers.

Get an elevation certificate to cut your overall insurance premiums by unlocking elevation discounts.

Distance-to-Water

Proximity to water enhances the risk of flooding. Living next to the beach or along a lazy riverbank may be the ideal way to live, but it also makes your home and business more vulnerable to flooding.

The distance-to-water metric is calculated using old-fashioned maps to determine where you are and how far away you are from permanent bodies of water.

This metric is combined with property elevation to develop your actual flooding risk.

Find Competitive Flood Insurance Rates with Rocket Flood

So, how much is flood insurance for you?

We are determined to help you get the lowest flood insurance rates at Rocket Flood. We believe that you should only pay what you have to.

Here's how we work to lower your flood insurance cost calculator reading.

Advanced LiDAR Technology

Elevation discounts are vital to lowering your flood insurance premiums. Unlike other insurance platforms, we use the latest technology to unlock those discounts.

We work with A-rated insurers across your state to ensure you receive the service you deserve. When you choose Rocket Flood, you gain access to LiDAR technology.

Our proprietary technology is the same technology utilized by NASA and several U.S. government departments. The land surveying industry also uses LiDAR technology to determine accurate numbers on the elevation and terrain of your property.

Pay the price that reflects your actual flooding risk with Rocket Flood today.

Extensive Marketplace of Providers

Stop wasting your time manually clicking on different insurance websites to get the lowest rates.

Use Rocket Flood to get an instant flood insurance quote. Our partnerships with top flood insurance providers across the country ensure our clients can access the most reliable insurers with no loopholes.

Our partners go above and beyond to serve our clients when they need it most. With an A-rated Rocket Flood insurer, you will never be left unprotected.

FEMA Comparisons

FEMA is the top public insurance provider in the United States. They work with more than 50 insurers as part of their network through the NFIP to provide public flood insurance policies to their clients.

Contrary to popular belief, NFIP policies do not necessarily offer the best protection for the best price. While the market rates may be lower, you get less for your money.

Through our platform, we analyze the FEMA marketplace to aid in lowering the overall flood insurance cost to you.

Easy Signup, Affordable Rates

Get an instant quote on flood insurance directly from the market in three minutes or less. Our state-of-the-art platform is designed to simplify and streamline the process of obtaining flood insurance.

It takes only three steps to access affordable flood insurance rates with Rocket Flood.

Signing up for flood insurance is easy, but we do not believe convenience should come at a price. Let our cutting-edge quoting and comparison technology work in the background with just a click of a button.

So much goes into flood insurance premiums, and knowing where to get the best deals can be challenging without compromising your protection.

Flood insurance estimates come direct from the market with Rocket Flood, with real-time updates. Get the latest rates by signing up, requesting your quote, and learning what you can expect to pay.

With a team of professional flood insurance experts by your side, the power to secure lower premiums is in your hands.

Whether you want to determine how to get a flood elevation certificate or the total cost of flood insurance in your area, Rocket Flood can help!

Compare flood insurance premiums and get the coverage you need with Rocket Flood now.