Flood Elevation Certificate

What is a Flood Elevation Certificate and How to Get One?

Did you know that floods are the number one natural disaster in the U.S.? Approximately $2.4 billion in damages have occurred annually for the past decade.

Anyone can fall victim to flooding. Your home or business does not need to be situated in a high-risk flood zone for you to experience a flood event. At Rocket Flood, we believe everyone should hold a valid flood insurance policy to protect them should the worst happen.

Flood insurance providers offer elevation discounts for home and business owners that can prove their properties are at a lower flooding risk. Your flood elevation certificate is the document that measures your home's susceptibility to flooding damage.

Additionally, your elevation certificate is partially responsible for calculating the premiums you pay on your flood insurance. To obtain an elevation certification, you must have it issued through the NFIP, a program managed by the Federal Emergency Management Administration (FEMA).

As part of your elevation survey, several vital information points will also appear on your certificate, such as:

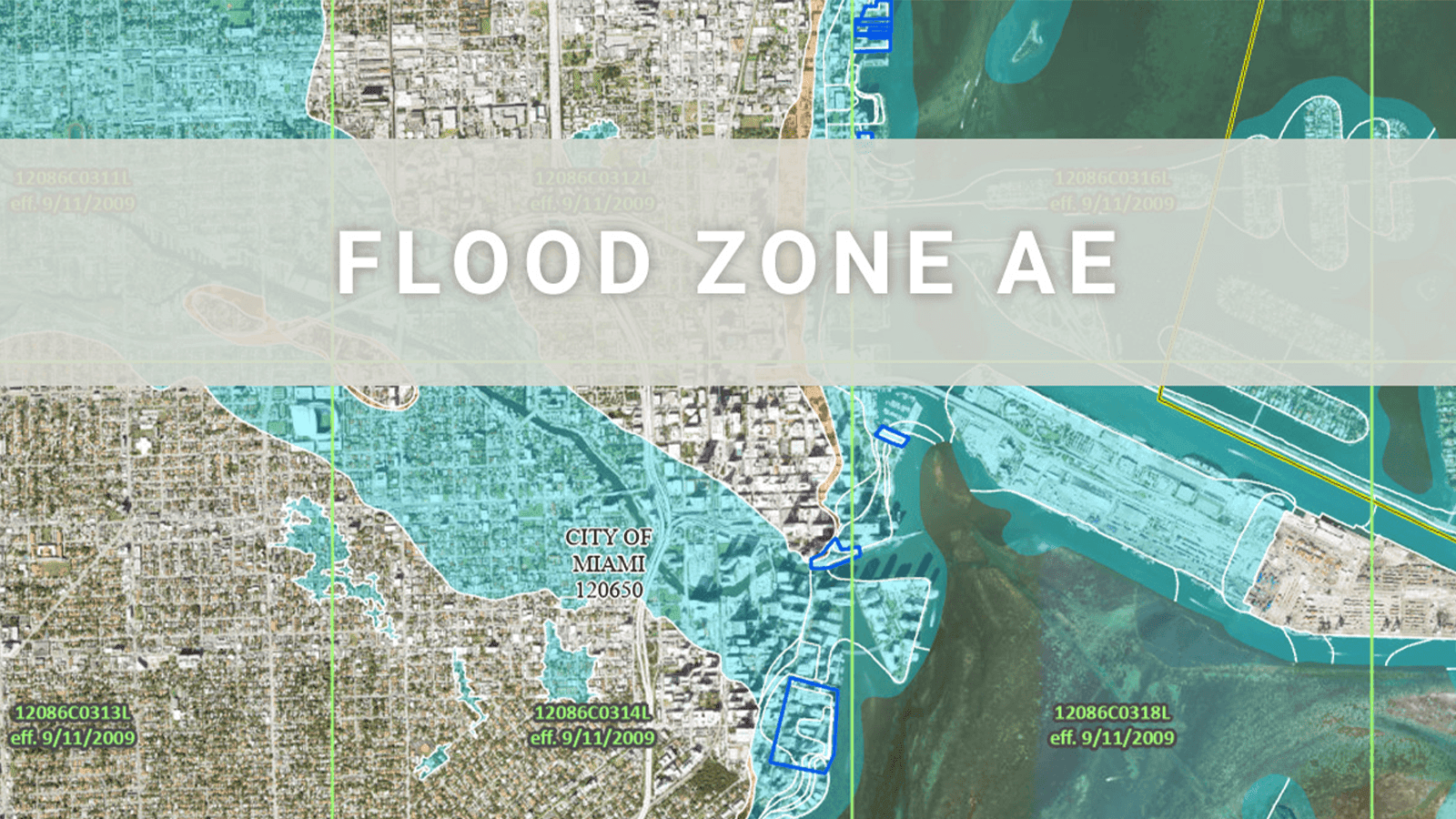

In the context of your premiums, your property's lowest floor elevation will play the most pivotal role. Once you have obtained your certificate, it will be compared with your location's Base Flood Elevation (BFE).

The BFE is what the NFIP estimates is the minimum elevation whereby there will be a 1% chance of floodwaters reaching in any particular year. The higher your BFE is, the lower your risk of flooding. To an insurer, a higher BFE will indicate a lower risk and thus grant you a lower premium.

At Rocket Flood, we can support you in obtaining the lowest possible rates on your flood insurance through our proprietary comparison software.

When Do You Need an Elevation Certification?

Only some properties require a flood elevation certificate. These certificates contain valuable information about your home. Still, you only need to produce one if you meet the following conditions:

Property owners only need to figure out how to get an elevation certificate if all the above conditions apply. If you are unsure whether all of them apply to you, the FEMA website can help you determine whether your home or business sits in a zone that is at a high risk of flooding.

Generally, if you fall into the “A” or “V” zones, you are in a Special Flood Hazard Area and will require an elevation certificate.

Note there is one exception to this rule. If your building was built before a flood insurance rate map was established in your area, you may be entitled to subsidized flood insurance rates without obtaining an elevation certificate.

But should you get an elevation certificate anyway?

At Rocket Flood, we believe the flood elevation certificate cost is worth acquiring because of how much it can impact your premiums. Ultimately, going through the process of obtaining a certificate can pay dividends in the long run.

How to Get a Flood Elevation Certificate?

Figuring out how to get a flood elevation certification is not always straightforward. These steps can guide you through the process.

Step One - Check for Your Elevation Certificate

Flood elevation certifications belong to the property, not the owner. A previous owner may have already secured a certificate for the property. In this case, it makes sense to do your due diligence to avoid paying the flood certification fee.

If one does not exist, search for an “elevation survey near me” and let them handle the complex job of performing all the necessary surveys

So, where can you find a free certificate?

Step Two - Pay the Price

Costs vary because you will need to shop around for someone who can certify the elevation measurements of your property.

The elevation certification cost will require you to search for a professional surveyor to authenticate the elevation information on your property.

The cost of this certificate will depend on the surveyor you choose. The average cost is $600, but prices can range from as little as $200 to a few thousand dollars.

Unfortunately, there's no way of averting this expense.

Step Three - Find the Right Surveyor

Professional surveyors are the only ones who can certify your property numbers. Hiring a surveyor and completing the certificate should take no more than a week or two, depending on where you live.

Do your research and find a trustworthy surveyor who can perform the work fast. Every day without flood insurance means your property is vulnerable.

Note that several professionals can offer these types of services. Some examples include:

FEMA recommends checking your state professional association or consulting with your state's NFIP coordinator. You can also ask friends and family who may have already obtained one of these certificates or carry out research online.

Once you have found your surveyor, ask them for an accurate timeline. They will organize an appointment to measure your property's elevation and should supply you with your completed certificate soon after.

After obtaining your certificate, you should have few problems securing lower rates on your flood insurance. All you have to do is present your certificate to your flood insurer.

The elevation certification cost is a small price to pay in pursuing lower premiums. We understand that the cost is the most common reason people fail to take out flood insurance, and every year thousands of Americans pay the price.

At Rocket Flood, we do not believe that protection for your home or business should break the bank. Using our state-of-the-art insurance comparison software, Rocket Flood allows you to secure the latest rates from dedicated A-rated flood insurers in your state.

Let our team guide you through locking in the best rates and ensuring you have all the necessary enhancements to keep your most valuable assets safe.

Start your search to lower flood insurance costs by comparing policies with Rocket Flood today.